In the year that it celebrates its 100th anniversary, the Chinese Communist Party has announced a slew of new policies which essentially amount to tighter regulation of much of the Chinese economy by the government. The laws aim to reign in the debt-ridden giants of China’s economy and put them on a path to sustainability.

In the year that it celebrates its 100th anniversary, the Chinese Communist Party has announced a slew of new policies which essentially amount to tighter regulation of much of the Chinese economy by the government. The laws aim to reign in the debt-ridden giants of China’s economy and put them on a path to sustainability.

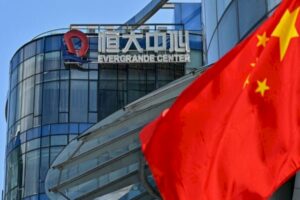

A crisis has emerged after new laws preventing property developers from borrowing excessively from banks were introduced. Evergrande, the second largest real estate developer in China and the world’s most indebted, has a business model based on borrowing. Founded in 1996 in Guangzhou by Xu Jiayin, Evergrande rode the Chinese economic boom through the early 21st century and was reported to be the world’s most valuable real estate brand in 2018. For decades, the company took out loans with double digit interest rates and gambled that its sales of yet-to-be-built apartments would be high enough to service dramatically rising debt levels. It currently owes USD 305 billion in loans to banks and liabilities to contractors and suppliers.

Recently, the implementation of the governments “Three Red Lines” policy – three strict caps placed on the ratio of debt a property developed can hold in relation to its assets, equity and cash-on-hand – has crippled the company. The policy prevents Evergrande from taking out loans it cannot pay back and using speculative market procedures to raise house prices. It is now required by government regulators to pay back its debts at a rate which is not practicable in the current housing market – the company simply cannot sell apartments quickly enough to service its debt.

Evergrande currently oversees over 800 unfinished residential projects nationwide, has a host of unpaid suppliers, and faces thousands of angry homebuyers demanding action against the company from the government. Buyers of an estimated 1.4 million Evergrande units all over China are now facing uncertainty over whether the properties they have paid for will ever be built. Evergrande investment products are now next to worthless and the stock value of the company has fallen by nearly 90% this year. The company is likely to default unless it successfully negotiates a restructuring plan with banks. Government regulators are currently trying to find companies that can buy out Evergrande or, failing that, seeking to take over aspects of Evergrande business themselves. On September 23, a deadline passed for Evergrande to pay $83.5 million in bond interest. Two people familiar with the situation told Reuters that bond holders had not been paid and neither had they heard from the company. A 30-day grace period follows which will end in default if Evergrande fails to come up with the cash.

Bo Zhuang, the chief China economist at United States investment firm Loomis Sayles, said that the government policies were part of a well-intentioned long-term programme to “de-risk, deleverage and shift away from local government land financing”. He warned, however, that the crisis at Evergrande, an inevitable side-effect of the policy’s sudden implementation, risked spilling over to other developers and could potentially cause a banking or debt crisis. The collapse of Evergrande could trigger a global financial meltdown similar to that which began when Lehmann Brothers folded in the United States in 2008. Global stock markets are already reeling and buyers spooked by the crisis mean developers are witnessing falling property sales and plunging stock prices. Foreign banks are exposed to Evergrande and there is a high risk of global contagion. Chinese government officials are reportedly “getting ready for the possible storm.”

The government is concerned about the potential for social unrest in the event of Evergrande defaulting. Protests have already been staged outside Evergrande headquarters and local governments have been instructed to contain any fallout from the crisis. Dexter Roberts of the Washington DC-based Atlantic Council’s Asia Security Initiative commented on the governments predicament: “A lot of Chinese people have a lot to lose if their property prices plummet as a result of a disorderly collapse of Evergrande. It will hurt people’s confidence. But on the opposite side, if the government is seen to have helped Evergrande too much, it will cause moral hazard.”

Print

Print Email

Email